It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for. — Robert Kiyosaki

Who wouldn’t want to achieve financial freedom right? Everybody would want enough or more than enough money and can say “Yes! I am financially secured. I got out of the rat race!”. But of course, all that money that you have or saved will be gone in an instant if you will not prepare and watch out for your financial health.

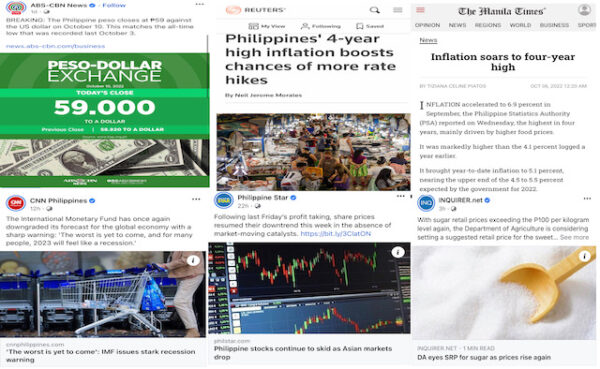

Anything can happen. You can lose your job, your business can close down, you or someone in your family can get sick, inflation can go up leading to rising prices of basic commodities. Believe me, these can put a whole in your pocket and would hurt your cash flow and savings especially if your source of income is not stable enough or not increasing to compensate for these financially-draining situations.

On the brighter side of things, you may not have control over what’s happening or what’s about to happen, BUT you do have control over the actions that you can make in order for you to still be able to save and be ready when financial instabilities happen.

So here are 5 tips that can help you save money:

1.NEED OR WANT? KNOW THE DIFFERENCE

He who buys what he does not need, steals from himself. – Swedish Proverb

Before making any purchase, always ask yourself first. “Do I NEED this?” or “Do I WANT this?”. Don’t get confused and remember not to mix them up, because knowing the difference between the two will have a big impact when it comes to your spending habits.

So…how will you know the difference?

- Needs are the things you can’t get by without, such as healthcare, shelter, food to eat, water and even air. Meaning, necessities or essentials.

- Wants are things that are nice to have but not necessary, such as subscription to entertainment media, gym memberships, additional house, extra phone, dining out, jewelries, new television, new bag, and a whole lot more. Meaning something that just will satisfy your temporary enjoyment.

TIP: Also do not decide to purchase anything when you are under stress or at the height of your emotion. This will greatly affect and cloud your judgement and ability to make wise choices between needs and wants.

2.RECORD YOUR EXPENSES AND EVALUATE YOUR SPENDING HABIT

It is very helpful to keep track of the money going in and out of your bank account. Make it a habit to record your expenses down to the last centavo. Collect the receipts may it be paper or digital. Also list down those you purchased without receipts. This way, you will be able to know where your money goes at the same time you will be able check if you have spent your money wisely.

Tracking your expenses can also become your marker to see if you’re over or under your monthly budget. Through this, you can evaluate and adjust your spendings and budget appropriation. For example, you are spending a lot on your frequent trips to the cafe to buy your coffee. Accumulatively, you know how expensive that can be right? If you regularly order a P150 cup of coffee/day, that’s P750/week and P3,000 per month. But if you will just make your coffee at home or make use of your office’s unlimited coffee supply, then it will be a lot cheaper and you’ll save a lot on your part. The money that you save can be of good use to other aspects like your healthcare savings, emergency fund, travel fund and others.

3.DO NOT LIVE BEYOND YOUR MEANS

You are walking in the mall, saw a big SALE sign. Then you convince yourself that since your salary is coming in a few days, you’d take out your credit card-swipe it away and went on a shopping spree!. This is a big No-No!.

If you really want to save, do not spend money more than you can afford. And even if you can afford it, ask yourself again. Is it a need? or a want?. Do not spend money that you still don’t have. Live within your means and protect yourself from being trapped again and again on the debt cycle.

This is why budget appropriation is very important. When you follow a strict budget allocation on things, you’ll be able to prevent yourself from spending more than what you are earning because you’ll know your spending limit.

4. CLEAN UP AND SELL(LIQUIDATE)

Clean up… clean up… clean up…. You’ll be surprised that there are a lot of things in your home that you have bought but can live without. Not only does this help declutter your home, But will give you extra cash as well.

Go through your closet, stock room, If you are having a hard time choosing and segregating, take the advice of Marie Kondo, a Japanese organizing consultant, author, known for her tidying skills.

“The best way to find out what we really need is to get rid of what we don’t. Quests to faraway places or shopping sprees are no longer necessary. All you have to do is eliminate what you don’t need by confronting each of your possessions properly.”-Marie Kondo

There’s nothing wrong to sell some things that you don’t really need. Do a garage sale or post and sell them online. Those items left unsold, you can donate(it would make someone happy). So, what should you do with the money that you earned? Again allocate. You may reward yourself for a job well done, but of course do not splurge. Put a portion of the cash for your money goals.

5.PLAN AND SET UP YOUR SAVING GOALS

According to Benjamin Franklin, “If you fail to plan, you are planning to fail”. Nobody wants to fail in life right? So better plan ahead and keep your eyes on the goal. Setting up a financial or saving goal will help you keep on track on what you want to achieve financially.

So how do you start?

- Define your financial/saving goals. Example: “I will save Php100 per day.”

- Make an action plan. Example: “I will not go to Starbucks today to save money. “

- Set a deadline. Example: “By the end of the month I should save P3,000.”

Believe me it’s not easy especially when you “want” something or when you struggle with impulse buying. It would really test your patience. But you have to start somewhere. Start small then start increasing bit by bit. You’ll find it easy to do eventually and you will develop a habit out of it.

As they always say, one should “SAVE UP FOR THE RAINY DAYS”. Yes! saving up is very important and the best time to start saving is NOW!

Do not save what is left after spending, but spend what is left after saving. – Warren Buffett

Leave a Reply